From coding audit type to budget, here’s what to consider before your next medical coding review

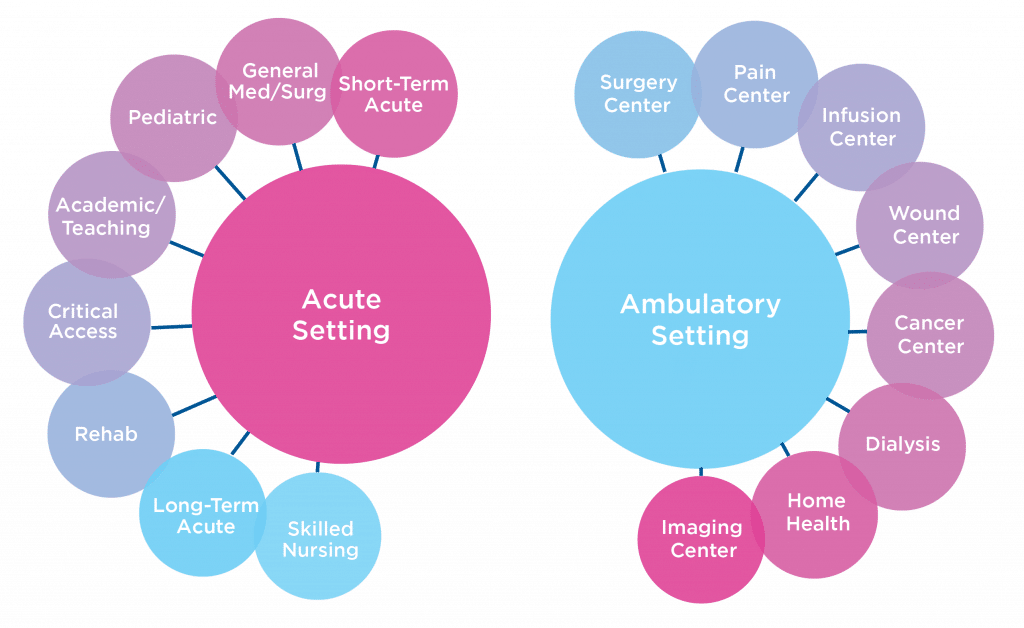

A medical coding audit is a process that includes internal or external reviews of medical coding and billing accuracy, procedures or policies in place, and any other component that affects the medical record documentation. Medical coding audits are a preventative measure to catch potential compliance errors that could result in liabilities or investigations. These compliance related issues can also impact your bottom line, your organization’s reputation, and most importantly, the level of care you deliver to your patients.

Retrospective or Prebill Coding Audit & Sample Methodology

Coding audits can be retrospective, a review of the submitted claims, or prospective, an analysis of coding prior to billing. Prebill audits can also impact other areas like quality measures and compliance scores as errors are corrected prior to final billing. On the other hand, these audits can raise your unbilled as more time is needed to review and finalize records. Retrospective reviews can allow you to focus on specific DRG’s, codes or procedures over a longer time frame to get an accurate picture if there is a potential area of concern. Both types of reviews have their advantages and HIA can help customize a plan to fit your organization’s compliance needs.

Once you have selected the type of audit, the next step is to determine sample selection methodology. Some organizations decide to select a random sampling of all their records from a specified period of time, while others will pull a random sampling from a targeted list: i.e., a new coder prebill review. We recommend clients perform a variety of coding audit methodologies in order to gain a better understanding of any compliance related issues. If you are using an external audit company to perform the reviews, they will usually select the records for you based on the parameters you set in place for the audit or through random sampling.

It is important to keep the objective of the audit top of mind when planning your next coding audit. At HIA, we believe in customizing a review to meet the client’s needs and the goal of the overall audit. For example, if the client is looking to determine if coding is adversely impacting CMI, we would look at a focused sample of records, likely DRGs with no CCs/MCCs. That same recommendation would not necessarily be made if the client is looking to determine how their coding staff is performing. In that case, we would likely recommend a standard interval coding quality audit, random sample, that would be more representative of the coding performed on a day-to-day basis. Budget is also a main factor to consider in an audit. If the client has multiple objectives, but they do not have the funds allocated to meet all of those objectives at once, we can help determine how to get the best bang for their buck, while establishing a timeline to meet all of their needs.

Accuracy & Productivity

Accuracy and productivity are both immensely important in the overall auditing process. Coding accuracy can be indicated by performing regular coding audits, while coding productivity is more of an operational/management indicator. However, your rockstar coders will be able to maintain both a high coding accuracy and productivity. It is important to determine where your coding staff’s strengths and weaknesses lie in order to manage your department effectively.

Budget

Coding audits can seem costly at first, but the benefits far outweigh the risks a facility may discover when coding hasn’t been regularly reviewed. A coding audit can identify potential at-risk dollars, i.e., overpayments and underpayments. Medicare defines an overpayment as any payment that exceeds amounts properly payable under Medicare statutes and regulations. When Medicare identifies an overpayment, the amount becomes a debt you owe the Federal government and Federal law requires CMS to recover all identified overpayments. Medicare overpayments commonly occur due to:

- Incorrect coding

- Insufficient documentation

- Medical necessity errors

- Processing and other administrative errors

Overpayments must be returned within 60 days from the date the overpayment was “identified,” or by the date any corresponding cost report was due, whichever is later. Failure to return an overpayment has severe consequences.

The best way to maintain compliance is to schedule frequent external coding audits. Two eyes are better than one. Routine coding audits can help you uncover any underlying issues and allow you time to put corrective action in place, so the issue doesn’t continue (and you won’t be forced to pay back the government!). The cost of a well-executed coding audit is well worth it in the long run.

Selecting an external auditing company

When selecting an external auditing company to perform your medical coding audit, you should keep in mind your overall audit objective and ask yourself the following: Does the company provide a review that meets your audit parameters? Do they schedule a review prep call and have consistent communication throughout the audit? Do they offer an audit exit call to discuss any review findings with you and your team in a clear and educational manner? What type of reports are provided to you after the review? Does the company provide any continuing coder or provider education?

HIA offers both preliminary and final reports. Recommendation worksheets will be posted to our secure client portal each day throughout the engagement and preliminary statistical reports will be made available immediately upon conclusion of the chart review. Final narrative reports, including both a Report of Findings and an Executive Summary, will be available after an educational exit conference call. HIA has over 200 Action Plans available for both your coding and physician staff that are available for Continuing Education Credits.

Partnering with an experienced coding consulting company, like Health Information Associates, can produce measurable improvements. Better documentation and coding lead to better data, information and insight into patient care issues that, ultimately, leads to better patient care.